Dear Anonymous:

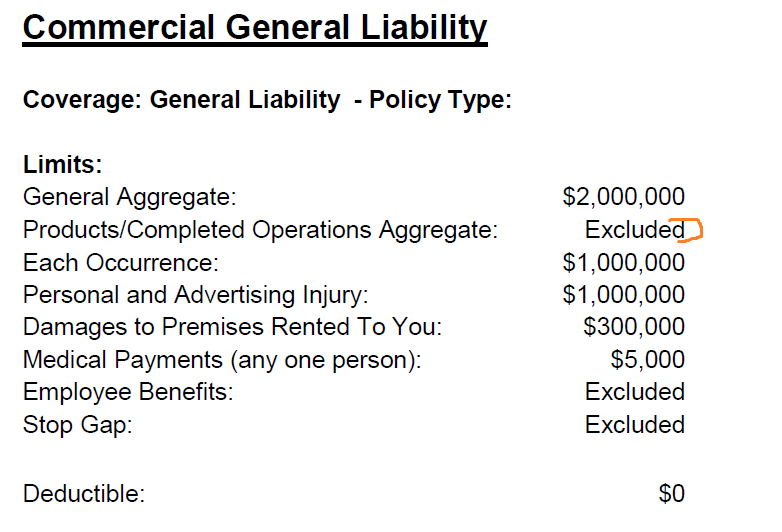

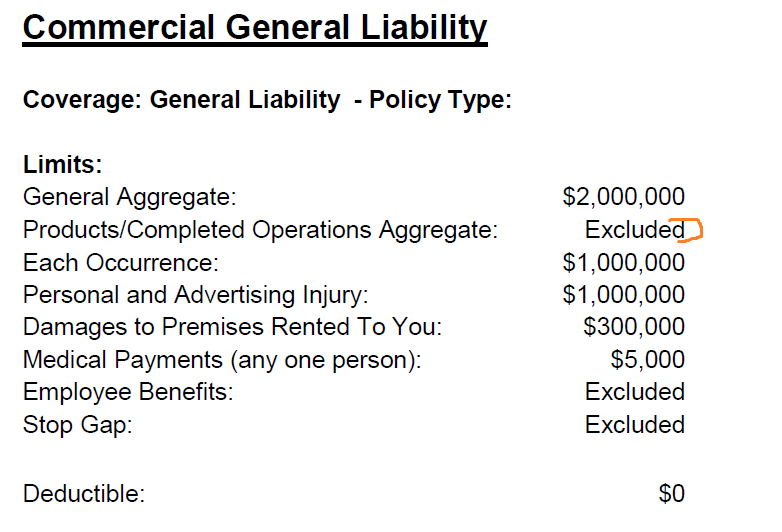

Thank you for your question on areas a cannabis business may be surprised no coverage exists. Most cannabis commercial insurance policies exclude "products and completed operations" or product liability depending the individual circumstances. Essentially this means the cannabis and cannabis related products manufactured and distributed into the stream of commerce may result in liability from a third party with coverage not provided.

For example, a customer becomes sick from an edible or driving under the influence results in a car accident. In either example, the possibility exists the cannabis licensee may be the target for collecting financial damages such as medical, property damage, personal injury, and legal expense.

This is one example of a coverage that may be excluded or "surprise." There can be other surprises and depends on the needs of the cannabis licenses and competence level of the insurance broker. As such, we recommend the cannabi business evaluate their individual circumstances with an experience licensed brokers in their state of operation.

Product liabilty or Products and Completed Operation Exclusion (Sample Document):